Zukunftsweisende Bauwerke

Internationaler Hochhaus Preis.

Alle zwei Jahre wird der Internationale Hochhaus Preis von der Deka, der Stadt Frankfurt und dem Deutschen Architekturmuseum vergeben. Dieses Mal wurden aus über 1.000 Gebäuden weltweit 36 Hochhäuser für den Award nominiert, fünf davon haben es in die Finalrunde geschafft. Der Sieger wird am 1. November in der Paulskirche bekanntgegeben.

Oktober 2020

Der Internationale Hochhaus Preis (IHP) gilt als der weltweit wichtigste Architekturpreis für Hochhäuser. Er richtet sich an Architekten und Bauherren, deren Gebäude mindestens 100 Meter hoch sind und in den vergangenen zwei Jahren fertiggestellt wurden. Die Jury besteht aus Architekten, Tragwerksplanern, Immobilienspezialisten und Architekturkritikern. Sie beurteilt die nominierten Projekte nach folgenden Kriterien: zukunftsweisende Gestaltung, Funktionalität, innovative Bautechnik, städtebauliche Einbindung, Nachhaltigkeit und Wirtschaftlichkeit.

-

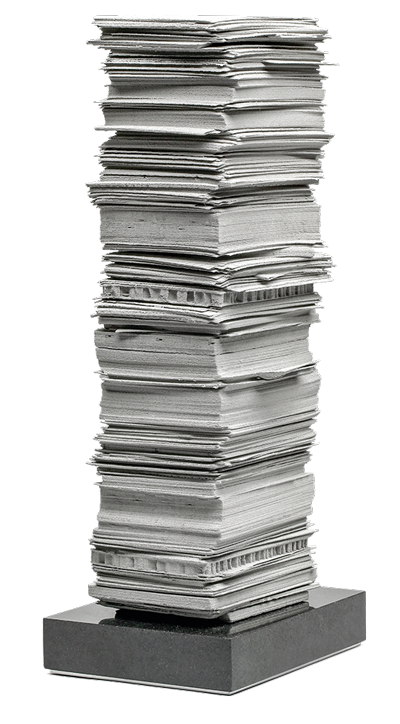

Der Sieger des neunten IHP wird am 29. Oktober in der Frankfurter Paulskirche ausgezeichnet. Aufgrund der Covid-19-Pandemie wird die Veranstaltung live im Internet übertragen. Die Auszeichnung wird von der Stadt Frankfurt am Main gemeinsam mit dem Deutschen Architekturmuseum (DAM) und der DekaBank verliehen und ist mit einer Statuette des international bekannten Künstlers Thomas Demand und einem Preisgeld in Höhe von 50.000 Euro dotiert.

Aufgrund der Covid-19-Pandemie und damit einhergehenden Reise- und Kontaktbeschränkungen fand in diesem Jahr eine digitale Jurysitzung statt. Der Sieger des IHP 2018 Benjamin Romano beteiligte sich zugeschaltet aus Mexiko an der Jurysitzung. Unter dem Vorsitz von Anett-Maud Joppien wurde angeregt und kontrovers diskutiert. Dabei standen die ökologischen und sozialen Qualitäten der Gebäude im Vordergrund. Auch der Aspekt der Widerstandsfähigkeit in Bezug auf die Struktur und den Lebenszyklus eines Bauwerks wurde an vielen Wettbewerbsbeiträgen geprüft.

Die Kandidatenliste mit fünf Finalisten steht stellvertretend für die enorme Bandbreite aller nominierten Gebäude: Einer der ersten gemischt genutzten Türme Deutschlands (Omniturm), ein üppig bepflanzter Luxus-Wohnturm (EDEN), ein brutalistisch anmutendes Wohn-Hochhauspaar (Norra Tornen), ein Hochhaus als Motor für die städtebauliche Entwicklung eines Viertels (The Stratford) und ein Paradebeispiel parametrischen Entwerfens (Leeza SOHO).

Mit dem Frankfurter Omniturm von BIG – Bjarke Ingels Group aus New York / Kopenhagen - hat es das erste Hybridhochhaus in einem deutschen Stadtzentrum unter die Finalisten geschafft. Für Jury-Mitglied Ina Hartwig macht der Turm seinem Namen alle Ehre. Es vereint Gastronomie, Büros, Wohnungen und Geschäfte unter einem Dach. Damit ist es im internationalen städtebaulichen Vergleich auf der Höhe der Zeit.

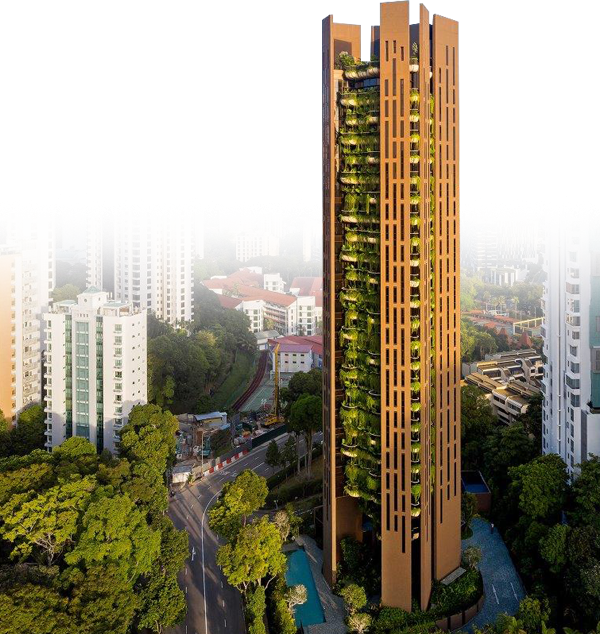

Erneut zählt ein Projekt aus Singapur zu den Finalisten. Muschelförmige Pflanzkübel machen EDEN von Heatherwick Studio aus London zum einprägsamen Beispiel für ein Wohnhochhaus. Mit seiner üppigen Bepflanzung zeigt es eindrucksvoll das Motto der Stadtentwicklung „City in a Garden“. Als „Garten Eden“ empfindet Jury-Mitglied Klaus Fäth das Begrünungskonzept, bei dem die Pflanzen durch zurückspringende Balkone und vorspringende Wandscheiben geschützt werden. Für die Juryvorsitzende Annett-Maud Joppien geht von den bauchigen Muschelmotiven und grünen Dschungeln eine große Anziehungskraft aus, der man sich nicht entziehen kann.

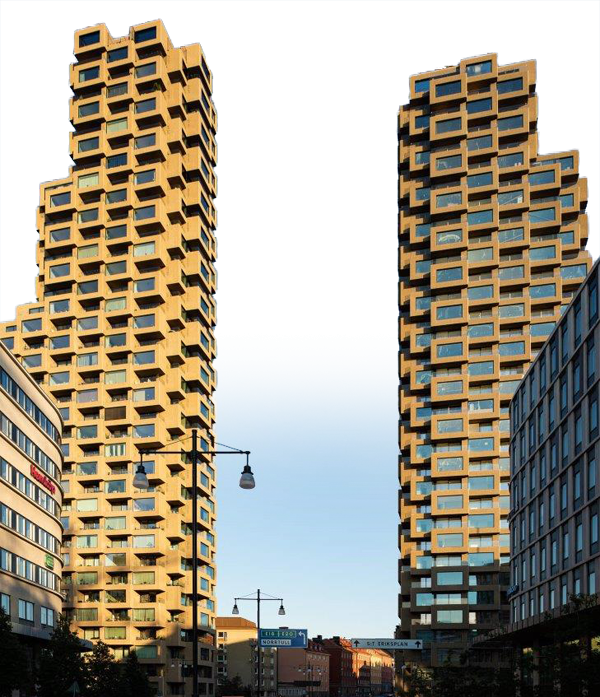

Norra Tornen von Office for Metropolitan Architecture (OMA) aus Rotterdam steht in Schwedens Hauptstadt Stockholm. Dort bildet das Projekt eine Torsituation zum Stadtteil Hagastaden. Die höchsten Wohngebäude Stockholms kultivieren das Wohnen in der Höhe mit ausgeprägtem Außenbezug im Norden Europas. Jury-Mitglied Andreas Moser lobt die Eleganz, mit der die Türme aus der sie umgebenden niedrigeren Bebauung hervorwachsen und bewertet das Spannungsfeld zwischen der brutalistischen Erscheinung der Türme und ihrem Kontext positiv. Auch Jury-Mitglied Victor Stoltenburg sieht in der Ausgestaltung der Baukörper mit modularen kastenartigen Erkern und der Oberflächengestaltung mit rauen Betonelementen einen bemerkenswerten Akzent im Stadtbild.

Mit einem weiteren Wohnprojekt ist das sonst für seine Höhenrekorde weltweit bekannte Büro Skidmore, Owings & Merill aus New York unter den Finalisten vertreten. The Stratford in London vereint Design-Hotel und Design-Wohnen unter einem Dach und setzt neue städtebauliche Akzente im Stadtteil gleichen Namens. Die markante Großform mit tiefen Einschnitten macht das Gebäude zum weithin sichtbaren Wahrzeichen. Die Räumlichkeit, die durch doppelte und einfache Raumhöhen im gesamten Gebäude geschaffen wird, seine begrünten und freitragenden öffentlichen Räume und die sorgfältige massive und transluzide Gestaltung der Hülle ergeben ein modernstes Hochhaus, das L. Benjamín Romano inspiriert.

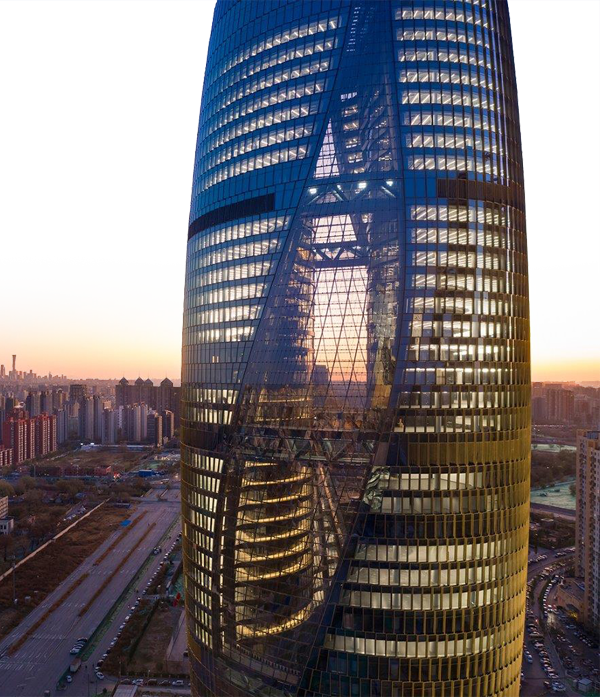

Eine herausragende Tragwerksleistung ist das Leeza SOHO von Zaha Hadid Architects in Peking, dessen Glashülle eigentlich eine Doppelturmanlage verbirgt. Das über 190 Meter hohe Atrium zwischen den Türmen ist das höchste der Welt, und seine faszinierenden geschwungenen Formen sind nur mit Hilfe des parametrischen Entwerfens möglich. Für Peter Cachola Schmal ist das Leeza SOHO die skulpturale Lösung eines Doppelhochhauses, das auf räumliche Überwältigung und Erlebnisse setzt für Hunderte von Small Offices und Homeoffices, die auf dem Weg zum neuen Flughafen ihr digitales Quartier

aufschlagen.

Internationaler Hochhaus Preis 2018.

Finalisten im Überblick.

Omniturm (Frankfurt am Main / Deutschland)

von BIG – Bjarke Ingels Group,

Kopenhagen / Dänemark, New York / USA

Eden (Singapur)

von Heatherwick Studio,

London / Großbritannien

Norra Tornen (Stockholm / Schweden)

von OMA Office for Metropolitan Architecture,

Rotterdam / Niederlande

The Stratford (London / Großbritannien)

von Skidmore, Owings & Merrill,

London / Großbritannien

Leeza SOHO (Peking / China)

von Zaha Hadid Architects,

London / Großbritannien